HODL Gone Wild: Meme Stock Mania in the Age of Algos

Manage episode 447612174 series 3586928

I’m in Buenos Aires this week, so I might be a little slow reporting on today’s budget, but I’ll come to it, don’t you worry.

Shortly before Covid hit, I became CEO of a Canadian company by the name of Cypherpunk Holdings (HODL.CN). I was very pleased with that ticker symbol—HODL. My idea. But I did not have a clue what would happen as a result …

I’m writing about the company today because, even though I stood down four years ago, I know a number of readers bought shares because I was the CEO. It’s quite a story.

Mining entrepreneur Marc Henderson controlled a shell company that had just received a large payout from the Mongolian government for some uranium assets it had seized illegally, as you do, and he wanted to use the opportunity to start a crypto business. We knew each other from way back, and he approached me because of my book.

He also brought in Canadian bitcoin entrepreneur Moe Adham, and Moe and I put together a proposal to become a privacy tech investment company.

We were both quite ideological about it. We had grave concerns about the increasing imposition on our privacy from both Big Brother and Big Tech. We felt it was only going to increase, and that therefore there would a need for privacy tech—anything from VPNs to private messaging apps such as Signal, to bitcoin and privacy coins. How right we were. Look at some of the stuff that went on during Covid.

Perhaps where we misjudged was that we thought there would be a large appetite for privacy tech amongst the general public as a result. It turns out most of the general public care more about convenience than they do about their privacy, at least online. In many cases, they don’t even realise what they are sacrificing.

Buying gold to protect yourself in these uncertain times? I recommend The Pure Gold Company. Pricing is competitive, quality of service is high. They deliver to the UK, US, Canada and Europe or you can store your gold with them. More here.

Once we were up and running—and, believe me, there was a lot of compliance—I brought in my mate, bitcoin OG Jon Matonis, and we began the process of acquiring bitcoin. We would hold large amounts of bitcoin. (This was before Michael Saylor’s Microstrategy, which has been a big winner for the portfolio since we tipped it last summer it around $30 - now $220 - especially as bitcoin closes in on all-time highs).

Upgrade your subscription.

One of our key investors was poker champion Tony Guoga, who bought an enormous stake in the company and eventually joined the board to become Chairman.

I stood down shortly after my dad died in April 2020. (From a financial point of view, that was a mistake, as I would have several million options now with the stock itrading at two bucks).

But, despite the good work that the company was doing on the ground, the great investments it was making, and the phenomenal board, it just kept trundling along sideways, largely ignored by the investment community and trading at around half its NAV. Like a champ, Tony Guoga kept on buying stock, especially on dips, building up an enormous position. He owns about 35% of the company. Talk about management being aligned with the interests of the shareholders.

Recently, however, the company had a rebrand. With all the bitcoin ETFs, it was pointless holding bitcoin, they thought, and the company decided to focus instead on SOL, which lacks a mainstream investment vehicle. Sol Strategies Ltd became the new name, and, a few months earlier, they brought in a new CEO, Leah Wald, as well.

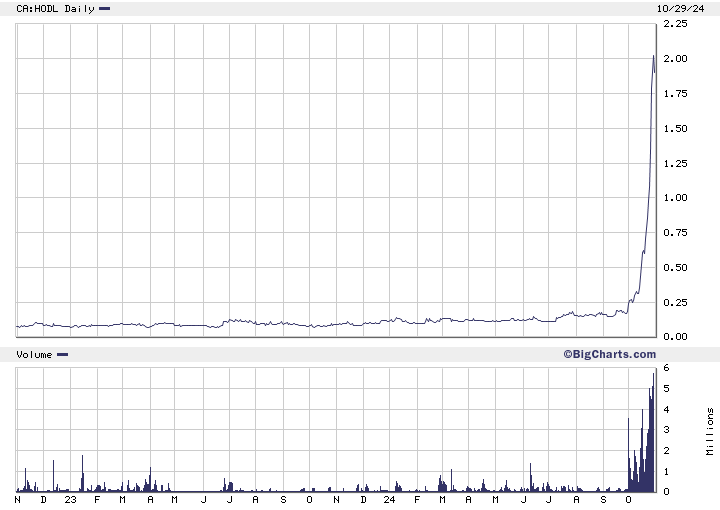

In the last fortnight, the shares have gone absolutely nuts—going from around twelve cents to above C$2. There have been several catalysts. First, Leah has made a number of well-received appearances in the media that have generated some interest in the stock. Second, it has become the easiest way to get exposure to SOL. Third, "HODL" is also the US ticker symbol for one of the bitcoin ETFs, and many Canadians, typing in HODL, accidentally bought this company instead. LOL.

Veteran traders will know the chart pattern the stock has played out. I believe it’s known as the hockey stick.

Just incredible. And look at the volumes that have come in.

The market cap of the company went from about C$17m to C$335 at the top of the market yesterday. Guoga’s stake alone went from about C$6m to north of C$115m.

For years, the company was trading at half its NAV of C$30. Suddenly it’s trading at ten times.

From a technical point of view, it shows just what can happen to a company after it builds all that cause trading sideways for many years. When it spikes, it can really spike.

I gather that it’s become something of a meme stock, so who knows when this will end? The algorithms have taken charge, especially on the US OTC markets where it also has a listing (CYFRF) and it is having daily swings of something like 30%.

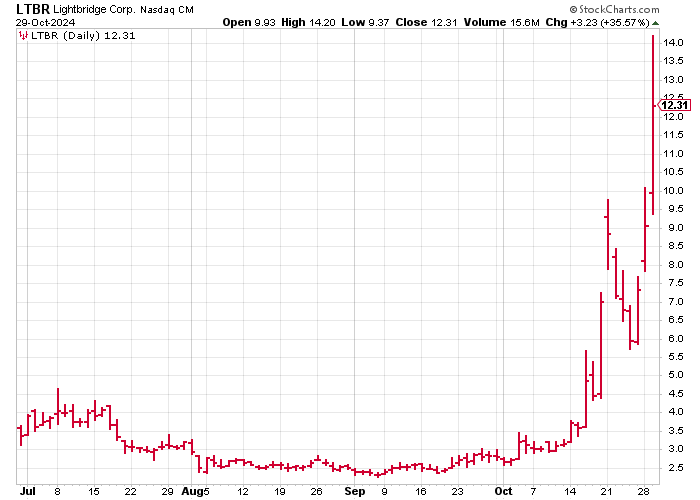

It even makes Lightbridge (LTBR) look calm. Have you seen that, by the way? $14 yesterday. It was $3 a fortnight ago, when I wrote it up.

Another hockey stick:

My broker commented that it’s good to see some animal spirit has returned to the markets.

I’m just amazed at what algos can do to small-cap North American stocks. Talk about speculation.

Casino!

Let’s hope one day they discover AIM.

I don’t know if this kind of speculation signals a top. It’s pretty obvious to me Trump is going to win next week, so maybe that’s all priced in and markets pull back after the election.

Crash ahead?

On which note, I leave you with this crazy interview. It was recorded in March of this year, several months before the Trump assassination attempt in July, and yet predicts it with incredibly accuracy. He also predicts the weird weather, a Trump win, followed by a 1929 stock market crash. Watch a minute or two from around the 11-minute mark (it should start there). Nuts.

I bet there are a gazillion things he’s predicted which haven’t happened. But I still thought it was pretty amazing.

I probably shouldn’t even be sharing this stuff, but I remembered it last night it from a few months back and, with the election coming next week, I went back and re-watched it.

What do you make of it?

Let me know in the comments.

19 episod